In Hollywood, the most creative people aren’t the writers, actors, and directors.

They’re accountants.

Hollywood accounting is undeniably unusual, especially to those who don’t work in the industry. But the idea that there’s some sleazy system of accounting designed to defraud investors, creatives, and crew is bullshit.

Nevertheless, a ton of naive people who don’t know shit about the business fly into L.A. every year with stars in their eyes. They get involved with a film that “will totally make $100 million” without understanding who gets that money. Then they feel screwed when their check comes in without enough, or any, zeros.

Hollywood accounting gets a lot of flack, so I want to take a minute to set things straight.

What’s the Deal with Hollywood Accounting?

Hollywood accounting is… creative… because of the ways income is recorded and contracts are written.

When a studio distributes a film, they either set up a corporation to produce the movie or arrange a deal with a production company (a/k/a “Prod Co”) who plans to make it. In either case, the film company is a separate entity from the studio.

Like any company, the Prod Co calculates profit by subtracting its expenses from its gross revenue. The studio charges the Prod Co big fees that dwarf the film’s revenue. So on paper, the Prod Co never has any profits to distribute, even though the studio makes bank.

Hollywood accounting is undeniably unusual, especially to those who don’t work in the industry. Click To TweetProfit participants who have power (the studio, primarily) make sure they get paid first from the gross receipts – money they receive from theaters. But profit participants who don’t have leverage often share in the net receipts – money left over when the production company pays all of its expenses – which is $0 or less.

If someone involved with a film wants to make real cash on the project, they’ll have to negotiate for a percentage of gross points. That’s the money made before expenses are paid out (remember, the studio’s fees are calculated as expenses).

Hollywood accounting is how a film studio makes sure it makes as much money as possible out of their investment. They don’t want to pay a single penny to profit participants they don’t have to.

Hollywood isn’t the only industry to structure their accounting practices this way. It happens in the recording industry too. There are plenty of music artists who sell millions of records but end up broke because they either didn’t understand the contract they signed or didn’t have leverage to get a better one.

Simply put, while most companies try to make more money by reducing their expenses, film production companies make money for the studio by maximizing their costs.

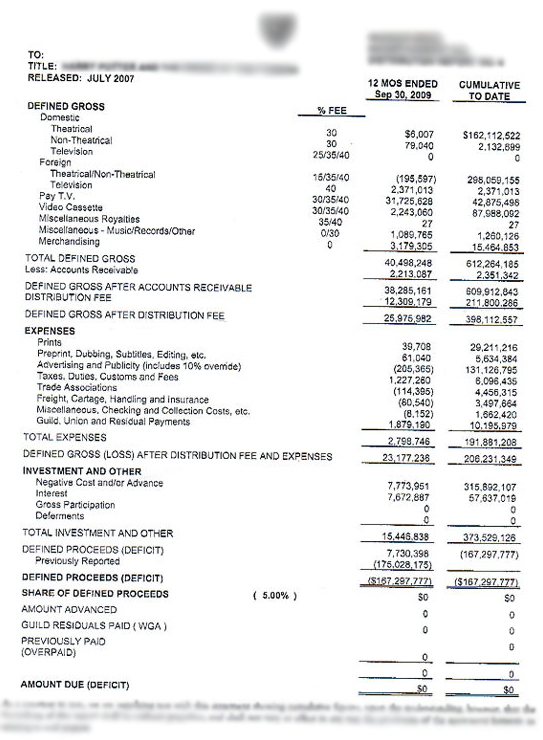

This type of deal-making isn’t an occasional quirk, either. It’s baked into the industry. HARRY POTTER AND THE ORDER OF THE PHOENIX grossed just under a billion dollars worldwide, but lost $167 million on paper. Warner Bros. charged the film company $350 million in distribution, advertising, and interest fees. See for yourself…

The cult movie THIS IS SPINAL TAP has only earned $179 in music and merchandise royalties for its creators.

RETURN OF THE JEDI was a similar predicament. It’s generated over half a billion dollars worldwide, but it’s never made a profit. Anyone whose contract entitled them to a percentage of profit – like David Prowse, the dude who played Darth Vader – got nothing.

A Practical Example

Let’s say you make a film for $15 million and successfully sell it to a studio for a guaranteed minimum of $12 million. If the movie grosses $100 million, you’ll make a cool $50 million on top of the minimum, right?

Not even close. You won’t split it with the studio. The studio will probably offer you 5-10% of the net revenue. How much is that?

Out of the $100 million (for simple math) …

- The theaters take half. You’re down to $50 million.

- The studio takes a 30% distribution fee. You’re down to $35 million.

- The studio deducts $10 million for its print and distribution costs. You’re down to $25 million.

- The studio deducts $20 million for its TV/Internet advertising costs. You’re down to $5 million.

- The studio deducts its overhead expenses and interest on the money they paid out in the beginning. You’re down to about $2 million.

Of that $2 million, you get 10%, which is $200,000. Congrats! You just made $12.2 million on a film that cost you $15 million to make. It’s a lot more complicated, but for illustration the math works.

Isn’t Hollywood Accounting Fraud?

No.

As someone who has worked in Hollywood’s financial trenches, I can confidently say none of this is fraud. It’s entirely legal.

The compensation terms between all parties are outlined in the distribution agreement. Anyone who has a profit share can see how much the studio will charge the production company before they sign their contract. They can see that the production company will never make a penny on paper. If they work with an agent, lawyer, or financial professional, any of those people should be able to help the creatives understand what they’ll get under those terms.

Furthermore, studios don’t use this kind of accounting to defraud the IRS. They still pay Uncle Sam the same amount on their consolidated corporate income statement that they would through each subsidiary film production company.

Interestingly, however, is that this type of accounting is mostly an American phenomenon. It’s considered fraud in a lot of other countries.

But Surely It’s Unethical…

Again, no.

It seems unethical to outsiders and the naive, but this kind of accounting is entirely above-the-board. This shit is contractual.

How a production company is obligated to pay a studio is defined in the distribution agreement. Investors and profit participants (or their lawyers or agents) are given all the information to sign off on.

Keep in mind that these studios are big, publicly traded companies. They WILL get tough and use all the leverage they have, but they don’t have any incentive to deliberately lie to you.

In fact, lying to you or refusing to meet their obligations as outlined in the distribution agreement can be more civilly and criminally damaging than abiding by the agreement.

To me, the whole point of a contract is to take ethics out of the equation. If we put our agreement on paper, the only way we can screw one another is if one of us doesn’t fulfill our end of the deal. But that’s easy to remedy in court.

That said, while the Prod Co and the studio are separate legal entities, they’re often run by the same people, so I see why that seems shady.

Let’s put it in a different context to unpack the ethical dilemma.

Imagine you run a hot dog stand with your partner Greg. You don’t want to share the profits with Greg. You want to keep all that sweet hot dog money to yourself.

So you start another company that sells hot dogs, buns, and condiments. Maybe you call it Hot Dog Supplies, LLC.

You buy supplies from this other company at crazy high prices – where all the terms of those transactions are defined in the agreement that Hot Dog Supplies and Greg signed. You charge your vending business so much, in fact, that there’s no profit to split even after you’ve sold out of hot dogs, but Hot Dog Supplies LLC made a shit load of cash.

You make money and Greg gets screwed. Fucked up, right?

Well, no. Greg surely knows where you’re getting your supplies. He’s either fine with it or you two have an agreement that puts you in charge of that end of the business. You’ll probably ruin your friendship with Greg, but hey man, this is business.

What This Means for Investors

Do some production companies, studios, and individual people behave unethically with money? Of course. Hollywood has its share of sinners.

And yeah, plenty of films have been sued because their accounting practices were really egregious. In some cases they deliberately assign big revenue to other projects that have no profit participants when making a large package sale, intentionally neglect to keep records, and make a lot of “errors.” In other cases, they just try to fuck people and hope they get away with it.

But you’ll find that shit in any industry. Tech, finance, manufacturing, farming… They all have their share of people willing to screw others to make a buck. When there is money on the table the moral compass has tendency to spin – and the more money there is the faster it spins!

Hollywood gets plenty of people chasing their dreams. They come to write, act, direct, invest, or just be part of the film industry. Often they don’t know how things work, make bad decisions, and get chewed up by the Hollywood machine that doesn’t suffer fools. But why should we fault the industry for some people’s ignorance?

Hollywood accounting is unusual, but it’s not illegal or unethical.